Overview

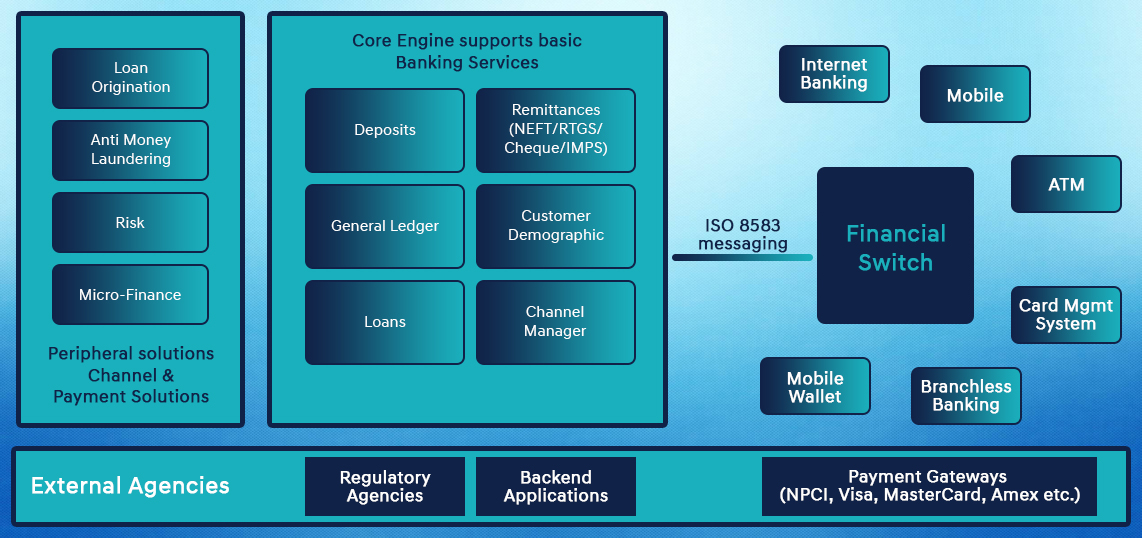

DataVision’s suite of products and solutions offer full-scope support to back-office and front-end processes of banking and financial services organizations, enabling them to provide services for unmatched customer experience on any device.

Core

Next generation Banking

DataMate™ is a complete

core banking solution

that tightly integrates

your banking processes

end-to-end.

Scalable, Secured Core

A light multi-currency, multilingual core application with rich functionality and an extensive degree of product parameterization.

Digital

SMS Banking Application

MessageMate is a low-cost, technology-enabled service offering banks to enable their customers to operate selected banking services.

Payment

Open platform, High-Performance EFT Solution

An open platform payment solution that offers efficient debit card processing services, reliable acquisition of devices, authentications, card management, settlements, switching to multiple networks and authorizations to card-based transactions from various channels.

Mobile Wallet (DV Pay)

Mobile phones today have the power to enable financial transactions between two parties, and recent estimates indicate that close to 2 billion users will be carrying mobile phones with payment processing capabilities by 2015. Consumers are demanding payment.

Risk and compliance

Risk management systems

With the implementation of Basel II and Basel III norms, regulatory agencies have obligated banks to establish suitable risk management systems and processes.

Human resources

Managing their human resources and other stakeholder groups – shareholders, management, compliance monitoring agencies, etc.