DataVision was founded in 1992 with the purpose of providing clients with customisable, scalable and affordable banking software products and solutions.

Uchil Heights, Jagdishnagar, Raj Bhavan Road, Aundh, Pune - 411007, Maharashtra, India

+91-20-25690661/2/3

info@datavsn.com

MBranch provides banks and financial institutions the opportunity to reach masses across the financial strata. MBranch's architecture encompasses a mobile device integrated with a biometric device, card reader and printer. It is backed by DataVision's impeccable record in managing integration and support services that will help financial institutions to add and service customers quickly.

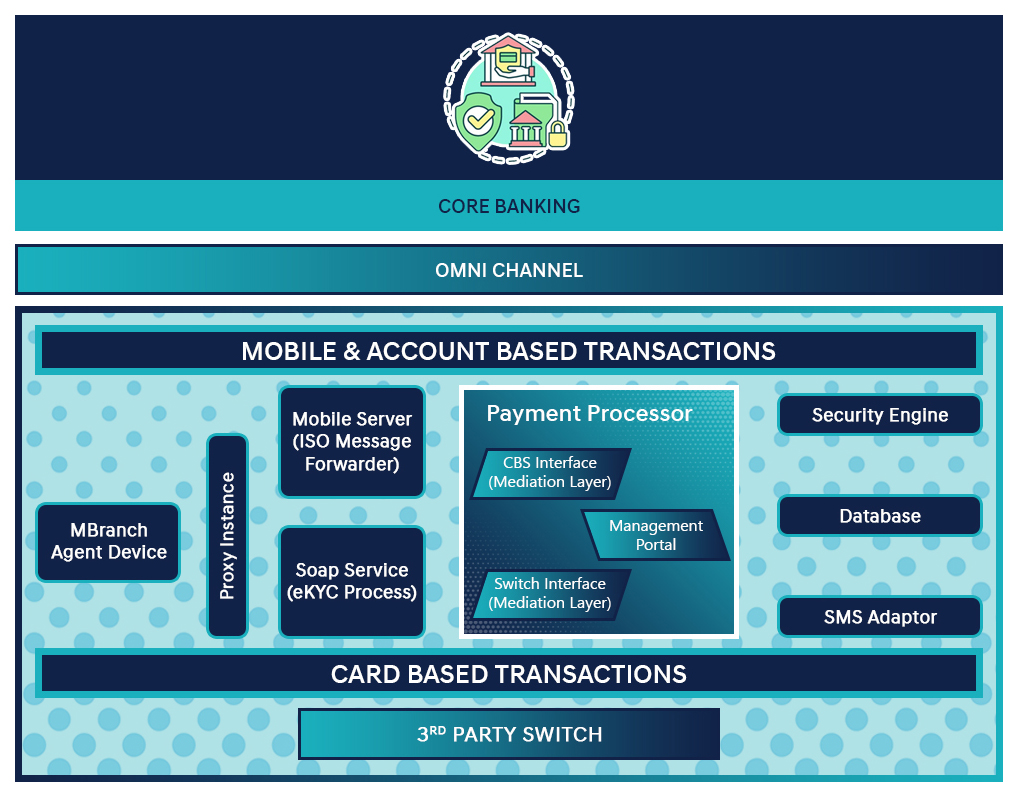

MBranch will help a financial institution’s customers to perform financial transactions such as Cash Withdrawal, Cash Deposit, Balance Enquiry and Funds Transfer through a biometric and PIN/OTP based mechanism or regular cards provided for banking. Typically, Remote Teller (Mobile application and other hardware components) talks to the Core solution of any vendor through the Financial Switch. Remote Teller is flexible and can scale across 3rd party financial switches whilst interfacing through both Mobile and Short Messaging Service (SMS) adapters for online and offline transactions. The entire flow of communication is conducted via ISO8583 message formats. The solution supports both ON-US and OFF-US transactions.

MBranch will enable the financial institutions agents to carry out financial transactions for the Customers, remotely.

Contact us for better Business. Call Us Now + 91-20-25690661/2/3

Compliance – MBranch is Micro ATM standards 1.5.1 compliant

Rich functionality – The application can function as a branch-less bank with functionally rich features

Transaction security – MBranch supports secure financial and non-financial transactions

The application supports secured biometric transactions as well as PIN based banking card transactions

3DES HSM based encryption and Identification for security

One way encrypted mobile number as part of SMS message to validate the originator

High Performance - The response time for a transaction is less than 5 seconds when data (Wi-Fi/3G) connectivity is available.

Scalability and flexibility

Portability and Low cost maintenance – The entire application and device is light

Interoperable across payment cards

Integration services – Quick and easy setup across Core applications

MBranch enables easy and convenient access to banking services for the unbanked rural population effectively

It limits avenues for siphoning of funds and corruption through a clear transaction flow supported through an audit trail.

The solution supports a wide range of payments such as peer to peer financial transaction, credit of pensions and subsidies provided by statutory bodies directly to the bank accounts of the beneficiaries.

MBranch is a cost-effective solution and has multi-language capabilities that supports a financial institutions financial inclusion objectives