The Rise of Agentic AI in Financial Decision-Making

In recent years, a new wave of technological advancements has revolutionized how we make financial decisions. Among these innovations, Agentic AI has emerged as one of the most promising tools in transforming financial services. This technology has shown immense potential, from everyday personal finance management to institutional trading systems. But what exactly is Agentic AI, and why is it gaining prominence in financial decision-making? In this article, we’ll delve into the rise of Agentic AI in global finance, its applications, and the challenges it brings to the table.

Understanding Agentic AI

What is Agentic AI?

Agentic AI refers to a category of artificial intelligence created to function independently in certain tasks. It makes choices based on algorithms and data evaluation, enabling it to operate independently. Unlike conventional AI, which typically needs human oversight or engagement, Agentic AI can utilize real-time information to guide its decisions and act independently. Agentic AI is shaping the future of finance, and companies like Datavision are leading the charge in digital transformation. Learn more about Datavision here.

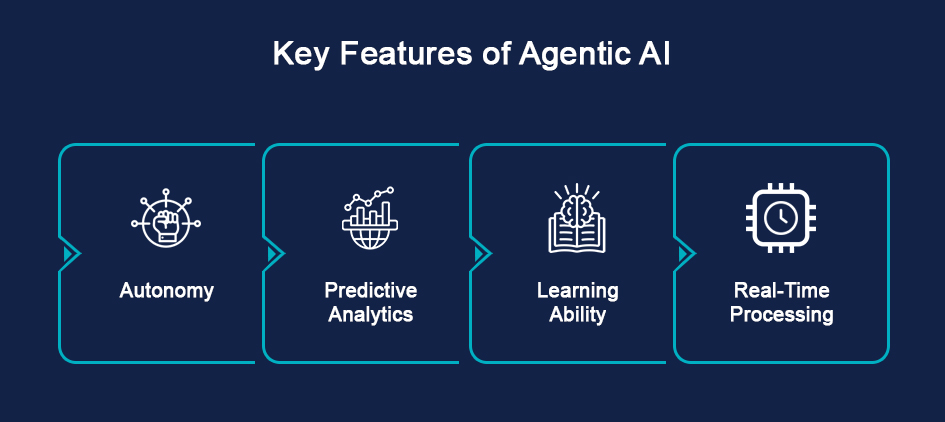

Key Features of Agentic AI

Differentiating Agentic AI from Traditional AI

While traditional AI requires substantial human input to function, Agentic AI goes beyond merely assisting humans in making decisions. It can act as an independent agent in its own right, often surpassing human capabilities in terms of speed, data processing, and accuracy.

Applications of Agentic AI in Financial Decision-Making

Personal Finance Tools and Robo-Advisors

Personal Finance Tools and Robo-Advisors

In the realm of personal finance, Agentic AI is used in robo-advisors—AI-driven platforms that manage an individual’s investments, suggest financial products, and create tailored financial plans. These tools use sophisticated algorithms to assess an individual’s financial situation and offer personalized advice, often at a fraction of the cost of traditional financial advisors.

AI in Stock Market Trading

AI in Stock Market Trading

The stock market has consistently been a field where rapid decisions can lead to significant outcomes. Agentic AI has grown increasingly important in high-frequency trading, as it can quickly analyze market trends and execute trades at remarkable speeds. These systems can identify profitable opportunities that may be missed by human traders, leading to higher returns for investors.

Institutional Use in Banks and Hedge Funds

Institutional Use in Banks and Hedge Funds

Banks and hedge funds have begun employing Agentic AI to manage large-scale investments, risk assessments, and credit scoring. Artificial intelligence systems can examine extensive data from worldwide markets and deliver practical insights that might take humans an excessive amount of time to analyze. This has improved the efficiency of financial decision-making across institutions.

AI in Credit Scoring and Risk Assessment

AI in Credit Scoring and Risk Assessment

Agentic AI is also used to assess the creditworthiness of individuals and businesses. By analyzing data from various sources (credit history, spending patterns, etc.), AI can provide more accurate and dynamic credit scores. This has significantly reduced the risk of loan defaults for lenders and allowed borrowers to access more personalized loan offers.

Datavision provides comprehensive core banking software solutions that support AI-driven financial decisions in banks.

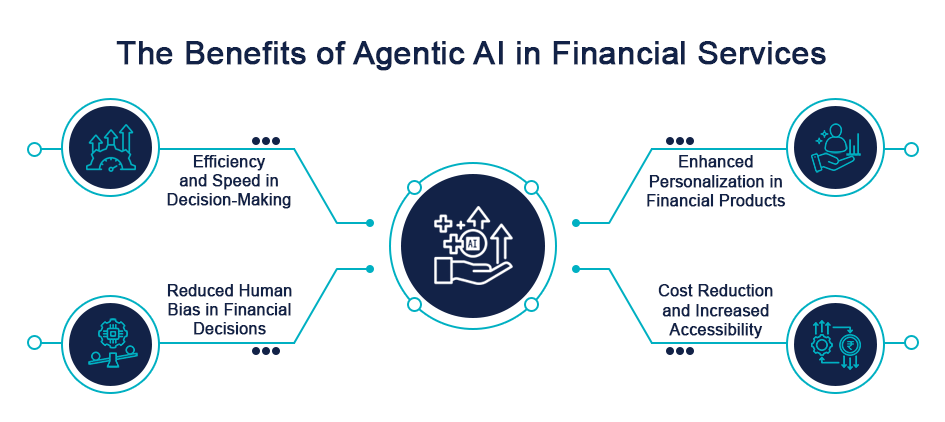

The Benefits of Agentic AI in Financial Services

Efficiency and Speed in Decision-Making

One of the key benefits of Agentic AI is its capacity to make rapid decisions. Time equates to money in financial markets, and the quicker AI can assess data and make decisions, the higher the profit potential.

Reduced Human Bias in Financial Decisions

Human biases, such as emotional decision-making or cognitive limitations, can often skew financial decisions. Agentic AI operates purely on data, reducing these biases and ensuring that decisions are made based on logical analysis.

Enhanced Personalization in Financial Products

Leveraging AI allows financial services to provide customized experiences tailored to personal requirements. Whether tailoring investment strategies, providing budget recommendations, or offering custom financial products, Agentic AI ensures each user gets the best possible service.

Cost Reduction and Increased Accessibility

By automating many financial services, Agentic AI helps reduce operational costs for financial institutions. This, in turn, makes financial services more affordable and accessible, particularly in emerging markets where traditional banking infrastructure may be lacking.

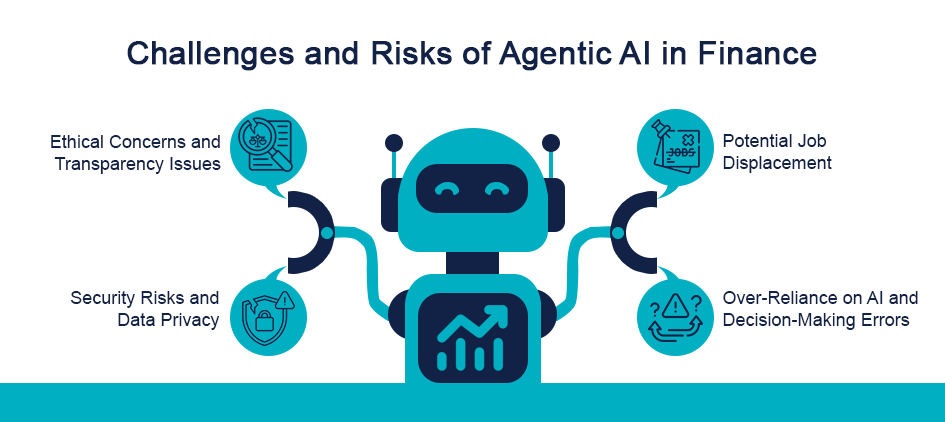

Challenges and Risks of Agentic AI in Finance

Faster Time-to-Market

The finance world is hyper-competitive. Whether it’s launching a new payment feature or responding to a regulatory update, speed matters. CT allows teams to deploy changes rapidly without compromising quality. Automated testing reduces the time needed for regression testing and manual QA cycles.

Ethical Concerns and Transparency Issues

AI decisions can sometimes lack transparency, raising ethical concerns. How do we know if an AI system makes decisions fairly and without bias? The opacity of many AI models challenges regulatory bodies and raises questions about accountability in financial decision-making.

Security Risks and Data Privacy

AI systems in finance often rely on massive amounts of sensitive data. This opens up new vulnerabilities, such as data breaches and privacy violations. Financial organizations must establish strong security protocols to safeguard individuals’ personal and financial data.

Potential Job Displacement

As AI continues to replace specific human roles, concerns about job displacement in the financial sector are growing. While AI may make some jobs obsolete, it could create new opportunities in data science and AI-related fields.

Over-Reliance on AI and Decision-Making Errors

AI is not infallible. There is always a risk of malfunction or incorrect predictions that could lead to significant financial losses. Over-reliance on AI, especially in critical financial decisions, could be dangerous if not properly managed.

Global Adoption of Agentic AI

Adoption Rates in Developed Markets

Adoption Rates in Developed Markets

Agentic AI has made significant inroads in developed markets like the U.S. and Europe, especially in wealth management and institutional trading. These regions have the necessary infrastructure and regulatory frameworks to support the rapid integration of AI technologies.

Growth in Emerging Economies

Growth in Emerging Economies

Emerging markets are also adopting Agentic AI at an increasing rate, particularly in micro-lending and digital banking. These regions see AI as a tool to leapfrog traditional banking systems and provide financial inclusion for underserved populations.

How Regulatory Environments Impact Adoption

How Regulatory Environments Impact Adoption

The regulatory landscape significantly influences the speed at which Agentic AI is adopted. Stringent regulations can slow down implementation, but they also ensure that AI systems operate ethically and securely.

Case Studies: Agentic AI in Action

Examples from Leading Banks and Financial Institutions

Examples from Leading Banks and Financial Institutions

Leading global banks such as JP Morgan and Goldman Sachs have incorporated Agentic AI into their trading systems. These AI tools can process large datasets and make trading decisions that help banks stay competitive in the volatile market.

Successful Implementations in Robo-Advisors

Successful Implementations in Robo-Advisors

Firms such as Betterment and Wealthfront utilize Agentic AI to develop customized investment portfolios for their customers. These robo-advisors have democratized wealth management, offering professional-grade financial planning at affordable prices.

AI-Based Trading Strategies and Their Impact

AI-Based Trading Strategies and Their Impact

AI-driven trading algorithms, such as those developed by Renaissance Technologies, have revolutionized the hedge fund industry. These strategies have consistently outperformed human traders, generating significant returns for investors.

Global leaders like Datavision have successfully integrated AI solutions into their systems, transforming financial operations. Explore their offerings here.

The Future of Agentic AI in Financial Decision-Making

Trends Influencing the Future of AI in the Financial Sector

The outlook for artificial intelligence in the finance sector appears promising, as advancements like quantum computing, the incorporation of blockchain technology, and the influence of regulatory measures are expected to guide its evolution.

The Potential for AI to Shape Global Financial Systems

AI may play a central role in global financial systems in the coming years. From managing national financial markets to assisting central banks in monetary policy decisions, Agentic AI could be a cornerstone of future financial governance.

Predictions for the Next Decade

Analysts anticipate that by 2030, artificial intelligence will be woven entirely into financial systems worldwide, emerging as a standard resource for financial organizations and personal investors. Its ability to predict market movements, assess risk, and execute decisions with minimal human intervention will continue transforming the financial landscape.

As we look toward the future of financial systems, Datavision is at the forefront of innovation. Discover how Datavision is driving change in the industry.

Conclusion

The rise of Agentic AI in financial decision-making is a game-changer. Its ability to make fast, accurate, and data-driven decisions has made it indispensable in modern financial services. Although there are still difficulties, the advantages significantly surpass the dangers. As artificial intelligence advances, its influence on the future of finance is expected to grow even more.

FAQs

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.