DataVision was founded in 1992 with the purpose of providing clients with customisable, scalable and affordable banking software products and solutions.

Uchil Heights, Jagdishnagar, Raj Bhavan Road, Aundh, Pune - 411007, Maharashtra, India

+91-20-25690661/2/3

info@datavsn.com

How cloud technology is revolutionizing the banking industry

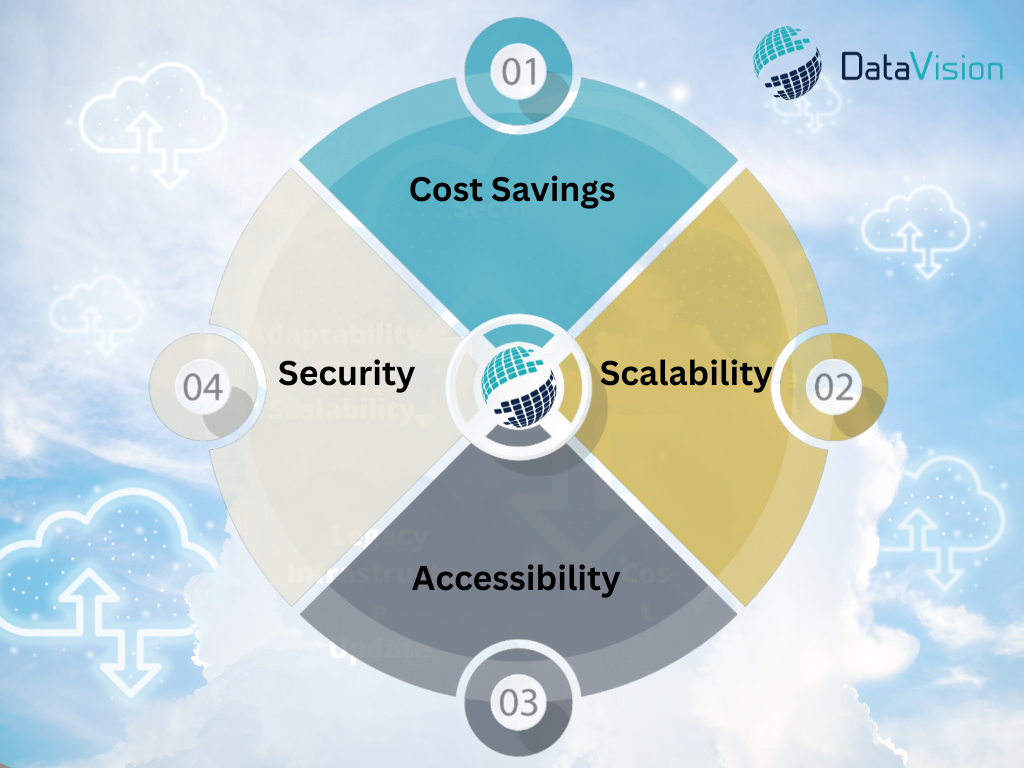

Over the course of the previous several years, the banking sector has witnessed a massive increase in the number of employees that use cloud computing. The flexibility to save money, increase or decrease storage space, and increase or decrease accessibility are all advantages of cloud-based systems. In this article, we will investigate how cloud technology is revolutionizing the banking industry as well as the benefits it offers.

Cloud computing can assist financial institutions in lowering their ongoing costs and upfront outlay requirements. For instance, by utilizing a cloud-based solution, financial institutions can reduce energy usage.

It is because they no longer require excellent on-premises data centres or power. According to findings from studies conducted by the Environmental Protection Agency (EPA), data centers are responsible for approximately 2% of global emissions of greenhouse gases. Financial institutions can reduce their energy consumption and carbon footprint by utilizing a cloud-based solution.

The use of cloud computing can also assist financial institutions in lowering the costs associated with their IT workers. A cloud service provider can take care of the management and maintenance of a bank’s underlying infrastructure when the bank utilizes a cloud-based solution. It can reduce the number of required IT workers and the amount of time and resources needed for infrastructure administration.

Scalability is another benefit we may realize by utilizing cloud technology in the banking sector. If the bank uses a solution hosted in the cloud, it won’t have to spend money purchasing additional hardware or software to add or remove resources, depending on its requirements. It is crucial for financial institutions like banks, which demand varying amounts of resources at various periods, such as during busy seasons.

For example, a bank that sees an increase in customer activity during the holiday season can quickly scale up its computing power to match the increased demand. Similarly, a bank with less activity during summer may reduce its workforce to realize cost savings.

Thanks to cloud technology, financial institutions can rapidly deploy their applications and data to various locations, which can assist them in expanding their operations throughout the globe. It can make it easier and quicker for financial institutions to penetrate new customer bases and markets.

For instance, a financial institution with its sights on expanding its operations into Asia can rapidly migrate its data and applications to a cloud data center serving the region. The bank could join the market more quickly and at a lower cost.

Cloud computing also provides a high level of accessibility to businesses operating in the financial sector. With a cloud-based solution, financial institutions can provide customers with access to their accounts and services from any location with an active Internet connection. Customers who are frequently on the go or live in more remote places will find this feature especially helpful.

For example, customers who travel internationally do not need to visit a physical branch of the bank to quickly check their bank account because they may do so from their smartphone or laptop computer. It can improve the customer experience and make banking transactions more accessible.

Utilizing cloud computing can facilitate improved access to financial services for personnel. A solution hosted in the cloud gives employees the ability to access their programs and data from any device, increasing both productivity and teamwork. It is optional for an employee working from home to download any software or connect to a virtual private network to gain access to the same programs and data they would have if they were physically in the office. As a result, we may reduce the time and effort needed to complete activities and enhance collaboration.

Adopting cloud computing in the banking industry has led to significant cost savings, increased scalability, and improved accessibility. Banks can improve their bottom line, provide better service to their customers and staff, and sustain their advantage over the competition in a world that is getting more and more digital by using a solution hosted on the cloud.

However, it is crucial to understand that cloud computing is not a problem-solving method that can be applied universally. Before settling on a solution that is hosted in the cloud, financial institutions need to evaluate their requirements and goals carefully. You can look into many different cloud options, such as public, private, and hybrid clouds. Each one comes with its own advantages and disadvantages.

Security

In the financial sector, security is paramount, and this is also true with cloud computing. Financial institutions must safeguard their customers’ private information, including banking and identification information. While most cloud service providers take security seriously, financial institutions still need to make sure their needs are met.

The Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation are two such regulations with which banks must comply (GDPR). Financial institutions can better manage their data security and regulatory compliance by using private cloud solutions.

The security of the cloud infrastructure is often managed and maintained by a team of security professionals employed by the cloud service provider. Most of the time, they offer a variety of security tools, including firewalls, intrusion detection systems, and encryption services, to ensure the safety of the data.

Banks can take some additional security steps to safeguard customer information by using multi-factor authentication, data encryption, and regulated access. While the security and compliance offered by cloud technologies are reasonable, it is the responsibility of the individual banks to guarantee that their own needs are met.

Private clouds, one type of cloud solution, give financial institutions a high level of control over their data and can help them meet regulatory and safety standards.

Banks should also equip their employees with knowledge of security best practices and emergency response procedures. Banks should routinely perform audits, penetration tests, and vulnerability assessments to help find security flaws and verify that preventative measures are effective.

Conclusion

In the end, the conclusion that it would be beneficial for the bank to implement cloud technology comes from an in-depth analysis of the many demands and goals of the institution. With the right cloud solution, financial institutions have the potential to reap the full benefits of cloud computing and maintain a competitive advantage in the rapidly developing world of finance.

How Can Datavision help?

We support a range of financial institutions and global banks on their digital transformation journey. Our unique strategy, which blends people, process, and technology, expedites the delivery of outstanding solutions to our clients and promotes excellence. Several reputable firms utilize our exclusive portfolio of business excellence tools and services to unlock new growth levers and achieve a ROI that is unmatched.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Get in touch with us for customizable, scalable, and affordable banking software products and solutions. Our portfolio of banking software product and services include:

Core Banking Solutions FinNext Core | FinNext Islamic Banking | FinTrade | EasyLoan | MicroFin

Digital Banking Solutions IBanc | MobiBanc | MBranch | FinTab | FinSight

Risk & Compliance FinTrust | InvestRite

Want to know how our team of experts at Datavision offer our reputed clients customisable, scalable and affordable banking software products and solutions? Visit us to know more.

Cryptocurrency and Blockchain: Opportunities and Challenges for Banks

May 6, 2024

Cryptocurrency and Blockchain: Opportunities and Challenges for Banks

May 6, 2024

Peer-to-Peer Lending Platforms: Disrupting Traditional Loan Processes

April 19, 2024

Peer-to-Peer Lending Platforms: Disrupting Traditional Loan Processes

April 19, 2024

RegTech (Regulatory Technology): Compliance Solutions for Banks in a Changing Regulatory Landscape

April 8, 2024

RegTech (Regulatory Technology): Compliance Solutions for Banks in a Changing Regulatory Landscape

April 8, 2024

How banks are leveraging technology to improve customer service and satisfaction

March 18, 2024

How banks are leveraging technology to improve customer service and satisfaction

March 18, 2024

The impact of regulatory changes on banking technology

February 29, 2024

The impact of regulatory changes on banking technology

February 29, 2024

The Future Of Payments

February 16, 2024

The Future Of Payments

February 16, 2024

How Do Banks Use Personalized Banking?

January 30, 2024

How Do Banks Use Personalized Banking?

January 30, 2024

How Neobanks and Challenger Banks are Redefining Financial Services

January 20, 2024

How Neobanks and Challenger Banks are Redefining Financial Services

January 20, 2024

How Technology is Revolutionizing Financial Inclusion for Underserved Communities

December 29, 2023

How Technology is Revolutionizing Financial Inclusion for Underserved Communities

December 29, 2023

How Regulatory Changes Shape Banking Technology in India

December 19, 2023

How Regulatory Changes Shape Banking Technology in India

December 19, 2023